Financial Obligation Buying Property: A Guide for Upstate New York City Capitalists

Property investment is a prominent method for expanding wide range, however owning property isn't the only way to benefit from the market. Financial obligation investing in property offers an alternative that allows investors to generate passive income by lending cash to property owners or developers. For those thinking about the Upstate New York real estate market, debt investing can be a clever method to take advantage of the area's financial development and realty need without the duties of property ownership. This article discovers the principle of financial obligation investing, its advantages, and how it works in the Upstate New york city property market.

What is Financial Obligation Purchasing Real Estate?

Financial debt investing in property involves supplying financings to homeowner or programmers for rate of interest repayments. The loan is safeguarded by the real estate itself, meaning if the debtor defaults, the lender has a claim to the residential or commercial property. Essentially, you're serving as the bank, providing money to a customer who uses the funds to acquire, develop, or enhance real estate.

Unlike equity investors, that own a share of the residential property and gain from residential or commercial property appreciation, financial debt financiers gain a fixed earnings with rate of interest payments. While the returns may be more foreseeable, they are commonly less than what equity financiers could make in a booming market. However, financial obligation investing brings less risk, as loan providers are often the first to be settled if the home is offered or seized.

Sorts Of Debt Investments in Property

There are a number of means to copyright estate financial obligation:

Exclusive Lending: Financiers can directly offer money to realty developers or homeowner. These fundings are frequently short-term and secured by the home.

Mortgage-Backed Stocks (MBS): These are swimming pools of real estate lendings packed with each other and marketed as safety and securities to capitalists.

Realty Investment Trusts (REITs): Home mortgage REITs concentrate on investing in realty financial obligation rather than equity, supplying financiers a method to purchase real estate finances through a varied profile.

Property Crowdfunding: Systems that pool cash from multiple financiers to fund realty jobs, frequently using both equity and financial obligation financial investment alternatives.

Why Buy Financial Obligation over Equity in Upstate New York City Real Estate?

Upstate New york city supplies a expanding realty market, driven by economical property rates, expanding organizations, and need for real estate in cities like Albany, Rochester, Syracuse, and Buffalo. While possessing home can be profitable, it additionally requires substantial time, initiative, and funding. Financial debt investing enables financiers to tap into the advantages of realty without the complexities of property monitoring.

Right here are a couple of reasons that financial debt investing in property might be attractive:

Lower Threat: Financial obligation investors have a greater concern when it concerns payment. If a consumer defaults, the lender has a claim on the residential property, lowering the threat of total loss.

Steady Income: Financial debt investments create consistent revenue through passion repayments, supplying a much more foreseeable return compared to the frequently ever-changing returns of equity investments.

Diversification: Financial debt investing enables you to diversify your portfolio by including a relatively steady investment that is not as subjected to market variations as equity.

Hands-Off Investment: Financial obligation capitalists do not have to stress over the everyday management of residential properties, lessees, or maintenance. When the loan is made, you can focus on gathering your passion payments.

Realty Financial Debt Investing Opportunities in Upstate New York City

Upstate New York is ending up being an significantly eye-catching market for real estate investment. The area is seeing population growth in vital cities, need for rental housing, and revitalization efforts in downtown locations. This offers countless opportunities for debt financiers to supply financing for property purchases, remodellings, or new growths.

1. Multi-Family and Residential Dope

As the need for economical housing boosts, lots of designers in Upstate New york city are concentrating on multi-family and property jobs. Financial obligation financiers can benefit by supplying temporary swing loan or long-lasting financing to developers that require funding to complete these tasks. Cities like Albany and Syracuse are seeing enhanced demand for houses and rental units, making this a possibly financially rewarding location for financial debt financial investment.

2. Commercial Property Funding

Upstate New York's commercial real estate field, specifically in cities like Rochester and Buffalo, is expanding because of Green Springs Capital Group economic revitalization and the expansion of sectors such as health care, modern technology, and education and learning. Financial debt financiers can lend to developers constructing or upgrading office buildings, retail rooms, or commercial homes, earning interest on the financing while protecting their investment with a lien on the property.

3. Fix-and-Flip Investments

The fix-and-flip market is solid in numerous Upstate New York locations, where older homes and buildings are being renovated and cost revenue. Financial debt financiers can provide temporary financing to capitalists wanting to acquire, remodel, and resell properties. These financings typically have greater rate of interest, supplying appealing returns in a reasonably short amount of time.

4. Real Estate Crowdfunding Platforms

For those curious about a much more hands-off method, property crowdfunding platforms permit investors to merge their sources and fund real estate financial obligation tasks across Upstate New york city These systems give comprehensive info on the tasks, allowing financiers to pick debt possibilities that align with their risk tolerance and return expectations.

Just How to Start with Financial Debt Purchasing Upstate New York City.

If you prepare to discover debt investing in real estate, right here are a couple of actions to get started:

Research the marketplace: Acquaint on your own with the Upstate New york city real estate market, paying very close attention to areas with high need for real estate and business development.

Evaluate Customers and Jobs: Prior to offering money, assess the debtor's credit reliability, the property's worth, and the marketplace problems. Make sure the lending terms are favorable, and there is sufficient collateral to secure your investment.

Speak With a Realty Attorney: Debt investing requires a sound understanding of legal contracts, loan terms, and foreclosure procedures. Deal with a realty attorney to ensure your financial investments are secured.

Expand Your Investments: Spread your financial investments across different borrowers and residential or commercial property types to minimize threat. Consider a mix of personal loaning, mortgage-backed protections, and crowdfunding chances.

Screen Your Investments: Stay informed concerning the efficiency of your debt financial investments and the general real estate market. Adjust your approach as needed to optimize returns while lessening risks.

Financial debt investing in Upstate New York realty is an excellent means to diversify your portfolio, create passive income, and minimize the dangers associated with typical building ownership. With the area's expanding demand for household and industrial homes, investors have countless opportunities to offer funding and Debt investing real estate New York gain stable returns. By doing detailed research study and thoroughly evaluating consumers, you can take advantage of Upstate New York's prospering real estate market without the difficulties of owning and taking care of building directly.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Traci Lords Then & Now!

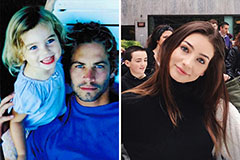

Traci Lords Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!